income tax calculator philippines

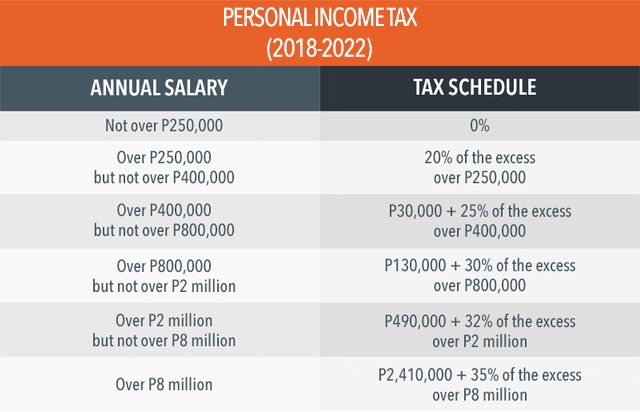

Tax computation in the Philippines changed this January 2018 in the form of the Tax Reform Bill of the Duterte Administration. Taxable Income MYR Tax Rate.

Taxable Income Formula Calculator Examples With Excel Template

How to use BIR Tax Calculator 2022.

. The calculator is designed to be used online with mobile desktop and tablet devices. January 21 2022 Updated. Tax rates range from 0 to 30.

Php 230000 x 008 Php 18400. Amendments to NIRC. For 2022 tax year.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. This calculator was originally developed in Excel spreadsheet if you wish to get a copy please subscribe to our Youtube channel. Income Tax Income Tax is a type of tax that governments impose on income-earning businesses and individuals.

Good thing that there are online tax calculators available in the Philippines to make everything easier for you. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. We are currently limited to computing the contribution for employed members only.

Where Does Your Tax Money Go. Philippine Public Finance and Related Statistics 2020. NTRC Tax Research Journal.

Annual Taxable Income Annual Personal Income Tax Estimated Monthly Withholding Tax Deduction. Tax Calculator Philippines 2022. VAT is a value added sales tax used in The Philippines.

It is an ideal choice for small-scale. Compute for the Income Tax. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income.

The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours. Just enter the Gross or Nett value and it will calculate the rest for you.

The results will be displayed. PhilHealth provides health and hospitalization subsidies to its members should they or their dependents be hospitalized. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

It provides employees with a practical means of paying for adequate medical care in the Philippines. Click on Calculate button. Income Tax Calculator Philippines Who are required to file income tax returns.

Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. The calculator uses the latest SSS Contribution Table 2021 for the computation.

Follow these simple steps to calculate your salary after tax in Philippines using the Philippines Salary Calculator 2022 which is updated with the 202223 tax tables. How to use BIR Tax Calculator 2022. Use the calculator below to find values with and without VAT.

The National Tax Research Center NTRC is an agency under the DOF that conducts research in taxation to improve the tax system in the Philippines. Tax Calculator Philippines This will calculate the semi-monthly withholding tax as well as the take home pay. Philippine Monthly Net Salary Calculator Published.

The general rate of VAT in The Philippines is 12 though some items are rated at 0. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. You must always be sure to go with the best efficient updated and legitimate online tax calculator program.

Statutory contributions such as Philhealth SSS GSIS and Pag-IBIG have their own computation set by the respective agencies and will still be deducted from the employees monthly salary. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. 2016 Guide to Philippine Taxes.

There are now different online tax calculators in the Philippines. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. Its online income tax calculator is quite similar in terms of features and functions to the DOF tax calculator except that the former provides more detailed information.

The current tax table is relatively simpler and allows employees to take. Select Advanced and enter your age to. Taxumo is the best option for digital tax filing in the Philippines.

Need more than a calculator. NTRC Tax Research Journal. No validation process is being performed on the.

Your Monthly Net Income. The Annual Wage Calculator is updated with the latest income tax rates in Philippines for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Income tax law provided in Tax Code of 19997 governs income tax procedures in Philippines resident citizens receiving income from sources within and outside Philippines fall under income tax category use this online calculator to calculate your taxable income.

It is the 1 online tax calculator in the Philippines. As a member of Social Security System SSS this SSS Contribution Calculator will help conveniently compute your monthly contribution. Review the full instructions for using the Philippines Salary After Tax Calculators which details.

Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Call center employee with a gross monthly salary of Php 20000 receiving 13th-month pay of the same amount earning Php 15000 monthly as a freelance photographer and availed of the 8 tax rate on business income. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Where Does Your Tax Money Go. Total Deductions Monthly Net Salary. Multiply the difference by 8 to compute the income tax due.

Philippine Public Finance and Related Statistics 2020. Please enter your total monthly salary. Figures shown by the calculator are based on the tax reforms tax schedule for 2017 2018 and 2019 including deductible exemptions and contributions.

Enter Your Salary and the Philippines Salary Calculator will automatically produce a salary after tax illustration for you simple.

Tax Calculator Compute Your New Income Tax

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Tax Calculator Philippines 2022

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Income Tax Calculation Formula With If Statement In Excel

2022 Bir Train Withholding Tax Calculator Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Excel Formula Income Tax Bracket Calculation Exceljet

How To Create An Income Tax Calculator In Excel Youtube

How Is Taxable Income Calculated How To Calculate Tax Liability

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Tax Calculator Compute Your New Income Tax

Provision For Income Tax Definition Formula Calculation Examples

2022 Bir Train Withholding Tax Calculator Tax Tables